From the folks at Global SWF LLC, a new report that is worth reading--The 2022 Annual Report: State Owned Investors 3.0. They describe the Annual Report this way:

State-Owned Investors enjoyed a tremendous ride during the past 12 months. AuM ended the year at an all-time high of US$ 31.9 trillion – due to the stock rally, to the recovery of oil prices, and, to a lesser extent, to the set-up of new vehicles. 2021 was a year of remarkable activity with 854 deals and an aggregate value of US$ 219 billion – 31% more than in 2020. SOIs were also prominent sellers and monetized US$ 32 billion in 45 transactions, half of which involved real assets. GIC and CPP led the league table followed by Mubadala, which won “2021 Fund of the Year” for several reasons, including its contribution to the advancement of the SWF industry. Do not miss our chat with its Chief Strategy & Risk Officer. Other key themes in the year included Venture Capital (Asset Class of the Year), which absolutely boomed; Australia (Region of the Year), which is increasingly important; and Healthcare (Industry of the Year), which has become crucial. For the first time in history, sovereign funds completed more “green” than “black” investments – and spent US$ 23 billion in renewable energy, from greenfield and brownfield assets, to stakes in listed companies and commitments in funds. There were many other matters, including changes in investment strategy, establishment of new funds; opening of offices overseas; and appointment of new CEOs. It is the new normal, or what we call State-Owned Investors 3.0. Enjoy the most timely, insightful and thorough annual report about SOIs' activity and trends. You can enjoy the web-based version at https://globalswf.com/reports/2022annual or download it as a pdf (it reads best in a two-page view).

For those interested in hearing us discuss the main findings of the report, Global SWF will host an open Zoom Webinar next Thursday, January 6, at 8am EST / 1pm GMT / 5pm GST / 8pm CST - register now at https://bit.ly/2022annualreport.

The Preface and execurive summary follow below.

I am delighted to present you our second Annual Report, launched on January 1 with absolutely no reporting delay. At Global SWF, our mission is to lead the research and analysis of the activities of the world’s major State-Owned Investors, by producing timely and insightful data and by staying relevant and independent. And we are uniquely positioned to do so, after providing services on the ground for many years and by nurturing a close relationship with all the important players.

Covering sovereign investors is both fascinating and challenging. On the one hand, they are intrinsically linked to their hosting economies and finances and there are usually more issues at stake than just pursuing superior returns. On the other hand, because of their global and heterogeneous nature, everything that goes on in the world, from geopolitics and pandemics, to climate change and technological disruption, unequivocally affects them. The industry is always evolving and can change significantly in a single year.

2021 was no exception. The world failed to get “back to normal” despite getting 4.5 billion people vaccinated against Covid-19 and entered a situation of great uncertainty that affected economies in different manner. Global GDP may have grown a 5.9%, but there is a general sense of discontent and insecurity among the population. COP26 highlighted the urgency of stopping global warming and of tackling resource scarcity. Other key concerns throughout the year included growing poverty, inequality, geopolitical tensions, rising energy prices, supply chain disruption, and inflation rates we had not seen in the West in three decades.

In that context, Sovereign Wealth Funds and Public Pension Funds continue to operate cautiously. The heterogeneity of the industry was magnified by the pandemic as some funds were asked for capital and / or for domestic bailouts, while others pursued opportunities overseas and greatly benefited from the stock rally. The line between asset owners and asset managers is becoming blurrier, with rising collaboration among them. SOIs are also looking at asset classes, regions, and industries in very different manner now. We argue that the pandemic has indeed marked a new phase, which we call State-Owned Investors 3.0.

At Global SWF, we were very busy and worked extremely hard to stay on top of it all. We have written 250 proprietary and original articles that were posted publicly on our website every weekday of the year, for anyone to read. Every first day of the month, we also distributed insightful newsletters to our clients, including interviews with the funds’ C-suite, and we released the first-ever mobile app to track SOIs’ daily activities. And all this has not gone unnoticed: our Data Platform is now trusted by a few dozen global clients including several SWFs; we have over 4,000 active followers in our social media channels; and we have been mentioned more than 200 times by the international media, including FT, WSJ, Reuters, Bloomberg, and Forbes.

We did much more than feeding our Data Platform and collaborating with media partners, though. We submitted formal academic articles to the Annual Review of Financial Economics and to the Journal of International Business Studies, delivered presentations at the UK Parliament in London and at the OECD in Paris among others, and completed several projects. I am particularly proud that we helped Framtiden and Fossielvrij identify the opportunity cost of not investing in green stocks for GPFG and ABP. After publishing our findings, the latter committed to divesting US$ 17 billion in fossil fuels by the first quarter of 2023.

I would like to take the opportunity to thank all team members – in particular, Daniel Brett – who have worked tirelessly to meet commitments and deadlines, as well as our esteemed advisory council, which has proven to be an effective sounding board to keep us on track. Also, our work would have not been possible without the excellent doing of our three partner-firms, Appoly, Odyssey, and Vizualytiks. We firmly believe in the global aspect of our business and have now team members, advisors and partners in all continents.

Please enjoy our annual report and we look forward to continuing our dialogue in the year ahead.

2021 was yet another formidable year for state-owned investors. Global stock markets, especially US stock markets have not stopped going up since March 16, 2020. In the 21 months to the end of 2021, the S&P500 has more than doubled, the Dow Jones Industrial Average grew 90%, and the S&P 1,200 Global Index was up 86%. And, for better or for worse, sovereign wealth funds and public pension funds still have a very significant exposure to American stocks – which has allowed most to score their best ever results, and to boost their AuM.

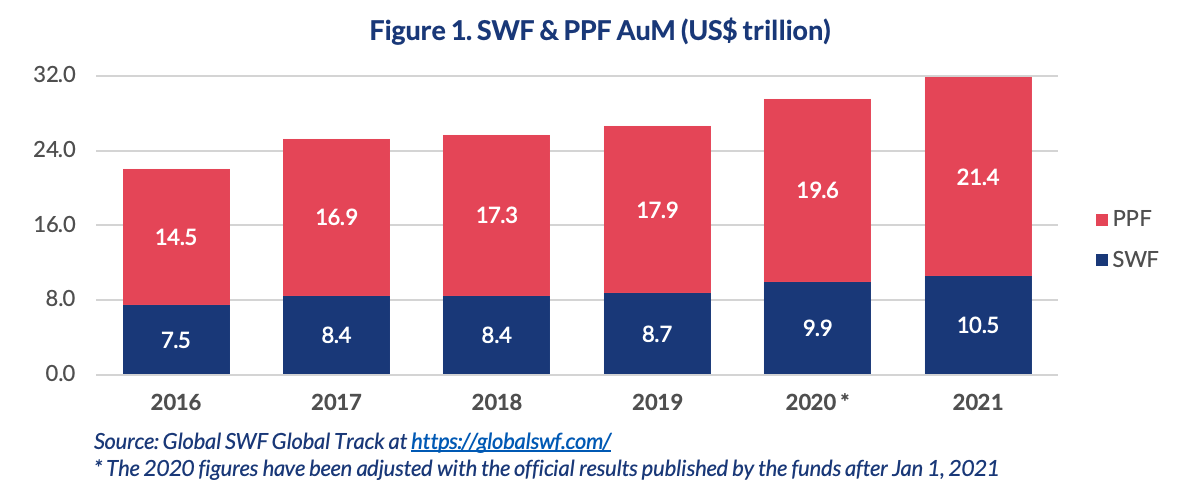

The size of the SWF industry increased a 6% year-on-year in 2021 and exceeded the US$ 10 trillion mark for the first time in history. This was not only helped by the price of equities, but also by the recovery of oil prices, and to a lesser extent by new funds established during the year. Public pension funds also accomplished a historical milestone after growing past the US$ 20 trillion and experienced a higher y-o-y growth of 8.7% due to increased exposure to US stocks, and to rising contributions from pensioners around the world.

There was a big disparity between the performance of the different asset classes during 2021. Fixed Income was the only asset class with negative returns, as measured by the S&P 500 Bond global index. Public equities continued to display a strong performance, according to the S&P Global 1,200 index. Hedge funds disappointed again with returns significantly below stocks. Private markets are always more difficult to track as SOIs do not necessarily carry out valuations every quarter, and if they do, they have certain lag. Yet, according to indices of listed companies, real estate was best performing asset class of 2021, followed closely by PE.

In 2021, state-owned investors deployed more capital than in any of the previous six years – both in terms of number of deals and in terms of deal value, which was over US$ 219 billion. Compared to 2020, SWFs deployed 19% more, with US$ 106.1 billion in 500 transactions; while investments by PPFs increased significantly in terms of both value and volume, up to US$ 112.9 billion in 354 deals.

GIC was again miles ahead of everyone else. The Singaporean SWF deployed US$ 34.5 billion in 110 deals, almost double of what it did in 2020. Almost half of that capital was invested in real estate, with a clear bias to logistics. The next biggest spender was CPP with US$ 23.7 billion, of which 61% was invested in real assets. Interestingly, both funds present a strong preference for North American assets and a smaller than average appetite for Emerging Markets. Other Top 10 funds including ADIA and Mubadala think differently.

Emerging markets only attracted 22% of the capital this year, one of the lowest figures in six years, to the benefit of Developed Asia-Pacific. Another key trend during the period 2016-2021 was the change in SOIs’ sectorial preferences. In 2016, over half of the deals were in the real assets. Today, that figure has decreased to a third of the total. The industries that have gained importance are, not surprisingly, healthcare, retail and consumer, and technology. All three sectors are touched by the magic wand of Venture Capital.

But not everything was private markets. Sovereign funds are now very active in stock markets around the world, and some have started diversifying away from the US markets. After the shopping spree of March 2020, PIF changed its strategy and consolidated its position by holding mainly ETFs and technology stocks – including a 63% stake in Lucid Motors, which tripled its holdings when it went public in October 2021. CPP demonstrated a strong interest in US equities, increasing its portfolio to US$ 88.3 billion (21% of its AuM).

China and India are providing an alternative to diversify public holdings. Most SOIs proved to be bullish on Chinese stocks, especially ADIA, which shut down its Japanese program to focus on China, and PIF, which recently applied for QFII status. Indian stocks on the other hand were dominated by GIC, with US$ 14.8 billion in holdings. This is in stark contrast with CDPQ, which sold most of its Indian positions.

SOIs were also active sellers in 2021 and divested US$ 32.1 billion in 45 transactions, half of which involved properties and infrastructure assets. Mubadala was very active with two IPOs and the sales of Aldar, Cologix, MATSA and Oil Search; CPP scored the largest monetization of the year when it sold 45% in GlobalLogic to Hitachi; PIF raised US$ 3.2 bn from the sale of 5% in STC; and ADIA exited Scotia Gas and various properties in Australia and China. Over the past six years, SOIs have monetized over US$ 285 billion.

Besides growth in assets and deal activity, one of the key trends we are witnessing is the change in investment strategy, and whether it makes sense for SOIs to stick to the traditional view of strategic asset allocation or to adopt a more streamlined and dynamic approach to portfolio construction. We discuss this in detail in Section 4 from a technical point of view, demonstrating that those funds that adopt Total Portfolio Management usually have better financial returns, suggesting that more funds may implement this approach.

We carefully evaluated performance and deal-making to consider which state-owned investor should be recognized as “2021 Fund of the Year”. There were funds that displayed high levels of deal activity; there were others that played a crucial role at home during the economic recovery; and there were others pursuing agreements with governments around the world. Only one SOIs combined all three factors and was therefore a worthy recipient of the award: Mubadala Investment Company. We are fascinated by the role the fund is playing in Abu Dhabi and abroad and were very happy to offer the prize to its Chief Strategy & Risk Officer.

The “Asset Class of the Year” was obvious this year, as Venture Capital absolutely boomed. Not only did VC investments by SOIs surged by 81% to a record US$ 18.2 billion in 328 deals, but VC also contributed to the globalization of their portfolios. Only 120 of these investments went to Silicon Valley, with the rest being distributed across 32 countries. SOIs switched preference to late rounds including pre-IPOs, which signals the entry of newer and more risk-averse investors. Temasek, CPP, GIC and Mubadala continue in the Top 5 league table and are joined this year by QIA, which is showing more activity in VC than in any other department.

The prevalence of big opportunities and increasing interest in its real assets, as well as the consolidation of its superannuation schemes, made us go with Australia for the “Region of the Year”. There is a fine line between inbound capital and outbound players as demonstrated by the privatization of WestConnex, with its proceeds going to feed the local SWF, the NGF. Canadian pension funds continue to lead foreign direct investments Down Under and have maintained offices in Sydney for several years. They will be joined by GIC in early 2022, which could also drive a fresh interest in the Australian start-up ecosystem.

Healthcare as a sector has been building momentum since the start of the pandemic in 2020, and it was a fair choice for the “Industry of the Year”. SOIs have backed some of the most known vaccine manufacturers and reaped some healthy rewards, especially ADIA in Moderna and Temasek in BioNTech. RDIF continues to drive the efforts to distribute Russian vaccine all around the world, which changed the whole dynamic of strategic funds. They were followed by other players including CPP, GIC and OMERS. However, the largest deals were seen in pharma (Acino, Amoun), devices (Medline, IVC) and services (Biomat, Healthcare Activos).

We are extremely happy to report that SOIs have, for the first time, invested more capital in renewable energy, than in oil and gas. This milestone was a few years in the making and has concluded a trend that has been driven by social pressure and financial returns and accelerated by the Covid-19 pandemic. State-owned investors spent US$ 22.7 billion in 37 “green investments”, including stakes in brownfield assets, investments in greenfield assets, shares in listed companies, and commitments to new climate-focused funds. We also continue to track the commitments around net-zero portfolios, which we expect to ramp up in 2022.

The document also explores organizational matters, including the establishment of new funds – and the depletion of others; the opening of new offices overseas – and the closure of others; and the appointment of new CEOs – and the dismissal of others. We saw a few leaders being removed overnight during 2021, including TWF’s Zafer Sönmez and Alaska PFC’s Angela Rodell. We interviewed them both, highly respect what they were doing in their respective funds and could not be more disappointed with the outcome. There were 18 other CEO appointments in 2021, which represents a high level of disruption and churn rate at the top.

Finally, we offer a revised our set of projections for State-Owned Investors 2030, which we started last year. It is never easy to predict 10 years down the road for an ever-changing industry like this, but we expect global AuM to reach US$ 53.6 trillion by the end of the decade. This could increase further if territories like Germany, Switzerland, Japan and Taiwan finally decide to join the “SWF Club”. In any case, we expect most funds to be underway towards their net zero goals by 2030 – and we look forward to telling you all about it.

No comments:

Post a Comment