I was delighted wit the opportunity to present "ESG Trouble--From the Center to the Ends of the Silk Roads--A Comparative Problématique" at the Annual Conference of the European China Law Studies Association 22 September 2023.

Environmental, Social, and Governance (ESG) has assumed a protean character in the West. To some extent it is a means of refining risk calculations for financial institutions. It has also morphed into a means of assessing the risk of engaging in specific economic activity, or in the forms that economic activity will take (respecting production, distribution,consumption, and reuse). But ESG has also assumed a substantial normative dimension, built into its technical standards. At the same time, its embrace also becomes a marker of forward thinking policy and an instrument in the front lines of transforming what elite western thinkers call "late stage" capitalism into some new benign or more public policy responsible form. At the same time, again reflecting the "flavor of the month" among Western thought leaders, it may represent a means of engaging with "surveillance" capitalism, in this case whether undertaken by liberal democratic or Marxist-Leninist economic enter`rises (or their state masters).

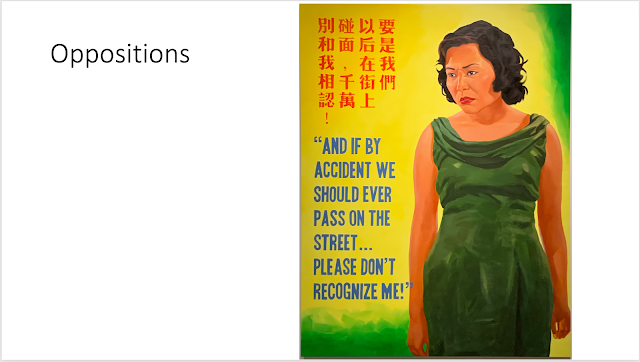

This is the point where things get interesting and where the exploration of my presentation starts. ESG presents three fundamental questions worth considering in related fashion. The first considers the evolution of ESG and its still to be realized aspirational objectives. Among these are data driven governance vectors for the nudging of behavior of public enterprises more aligned to public policy (without the bother of legislating compliance). If that is the case, one might consider whether ESG has an ideology. Here it makes sense to consider the alignments and divergences between liberal democratic and Marxist-Leninist ESG projects. Lastly, both seem to align with the "surveillance" bit. In this case one might pose two related questions--the first is the extent to which ESG measures might be considered to be well within the ambit of the mechanics and ideologies of Chinese social credit. The second is whether the modalities of social credit--data driven systems of punishments and rewards built around compliance with an ideal built into assessment standards--are not a foundational organizing basis for liberal democratic ESG measures. In other words--is the West embracing its own version of social credit data based regulatory systems through ESG?

The abstract lays this ut more formally:

Social credit regimes in China are well known to target trustworthiness. less well known is the interlinking between trustworthiness and risk, especially in the management and guidance of economic activity. That risk element is compounded when Chinese enterprises engage in economic activity both within and outside of China. In that context, Environmental, Social, and Governance (ESG) risk measures may play an important role. This presentation considers the relationship between ESG as a normatively objectified methodology for risk ranking, its alignment with the analytics and nudging strategies of social credit or data governance systems, and the challenges that arise where those regimes may produce disjunctions between home and host state regimes. The presentation starts with a brief consideration of social credit regimes as applied to economic activity within China. It then considers ESG measures as data-based system of normatively driven risk assessment and its interlinking with social credit modalities. The heart of the presentation then examines the operational characteristics of ESG as social credit in the operation of Chinese state owned enterprises and the challenges of aligning national with transnational ESG disclosures and analytics. The presentation ends with a brief consideration of the potential conversations between liberal democratic ESG social credit methodologies and frameworks and those emerging in and through the Chinese Silk Roads.

The PPT follow and may also be accessed HERE.

|

No comments:

Post a Comment