Global SWF has announced that it has unveiled the 6th edition of its GSR Scoreboard. The Scorecard assesses every July 1 the efforts of Sovereign Investors around Governance, Sustainability, and Resilience.

In its Press Release Global SWF explained:

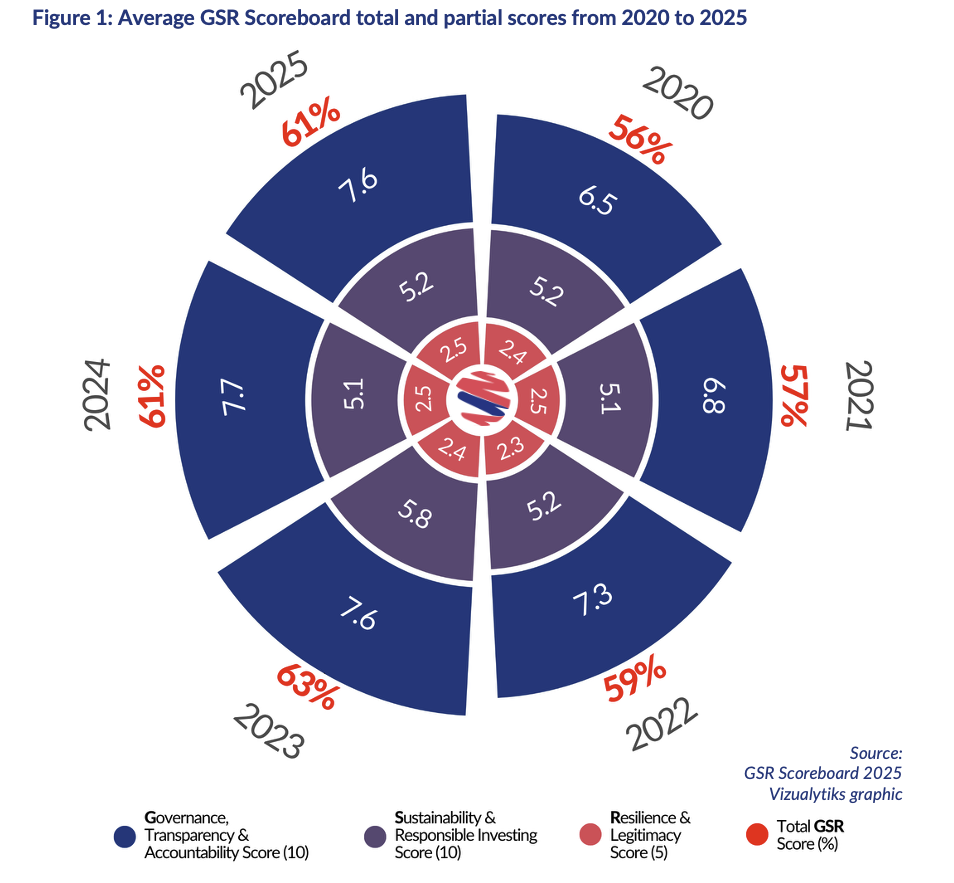

The annual assessment has become the yardstick for the industry’s best practices as it is rigorous, quantitative, and fully independent. This year’s main takeaways include:The average GSR score of all funds stayed flat at 61%. Sustainability scores continue to rise, but the average Governance score slightly dropped due to transparency issues. Geopolitics and trade tensions are taking over from sustainability as key concerns of the C-suite at Sovereign Investors, some of which are turning more domestic, isolated, and opaque. Nine out of the 200 institutions achieved a perfect score: Canada’s CDPQ, OTPP and BCI, Ireland’s ISIF, Saudi’s PIF, Nigeria’s NSIA, Singapore’s Temasek, Australia’s Rest, and NZ Super.

Seven new institutions committed to net-zero goals by certain timeline in the past 12 months – however, only 35% of the 200 Sovereign Investors are pursuing such targets. There continues to be a positive correlation between best practices and the financial performance of Sovereign Investors in the long run.

The report also includes a market update of what we saw during the first half of 2025 – in our normal fashion: plenty of data to digest, naming names, and with no lag in time.There is significant disconnect between Main Street and Wall Street, and financial markets continue to perform well, which has translated into new historical peaks for SWFs (US$ 13.9 trillion), PPFs (US$ 26.6 trillion), and Central Banks (US$ 17.0 trillion). Investment activity has dropped: US$ 100.8 billion in 225 transactions, with the average deal size increasing to US$ 450 million. The “Oil Five” (Saudi’s PIF, Abu Dhabi’s ADIA, Mubadala and ADQ, and Qatar’s QIA) and the Maple 8 Canadian funds were the two most active groups with 36% and 31% of global dealmaking. Flexible funds turned to investments in domestic markets, which peaked at 38%. Funds are still deploying overseas, but they are recalibrating their hedges. We continued to see increased activity in the establishment of new SWFs and branches all around the world, but also a concerning amount of funds and offices been shut down.

We are delighted to present the 2025 GSR Scoreboard, the most comprehensive analysis on the Governance, Sustainability and Resilience (“GSR”) practices and efforts of the world’s 200 largest State-Owned Investors (“SOIs”), including Sovereign Wealth Funds (“SWFs”) and Public Pension Funds (“PPFs).

The assessment tool was first introduced by Global SWF in 2020 to address central issues such as transparency and accountability, impact and responsible investing, and legitimacy and long-term survival. Five years later, the system is embraced as a key metric among sovereign and pension funds globally.

The scorecard is designed to be fully independent (as we are not commissioned by anyone to do it), quantifiable (assessing progress over time), and objective (based only on publicly available information). The scoring is based on 25 elements: 10 related to governance, 10 to sustainability, and five to resilience, which are answered binarily (Yes / No) with equal weight and then converted into percentage points.

The 2025 edition continues last year’s updates, namely the addition of three different sustainability elements, and the re-shuffling of all elements into sub-categories. We did not see the need to change any element this year, but we assess the scoring criteria annually.

The preliminary results were sent on May 10 to all 200 funds, which were given five weeks to provide comments or additional information. We were pleased to see an increased level of engagement, and since 2020, over 50% of the funds assessed have engaged, acknowledged and debated the scores.

The 2025 GSR Scoreboard see modest but meaningful changes. The overall average for all funds stays flat from 2024, at 61% - however, there is a slight decrease of governance scores due to several funds becoming more domestically-focused and opaque. On the positive side, sustainability scores continued to improve, with seven of the 200 funds committing to net zero goals in the past 12 months for the first time.

As highlighted in 2024, the regional diversity of the leaderboard is testament to the fairness of the assessment tool. The GSR Scoreboard is a great equalizer and sovereign investors demonstrate that best practices are not only found in Western markets and among the largest institutions.

Five sovereign investors repeated the success of last year and scored 100% once again: Canadian pension managers BCI and CDPQ, Ireland’s strategic fund ISIF, Singapore’s state owned investment company Temasek, and New Zealand’s savings fund NZ Super, which again secured the best financial performance of the past decade among SWFs.

Four additional funds scored maximum points this year thanks to the continuous improvement of their practices. Saudi Arabia’s PIF started issuing annual ESG updates, and Nigeria’s NSIA committed to net zero goals, so both SWFs met all sustainability points. And Australia’s REST and Canada’s OTPP shed a light on their operational structure, which ensured they met all governance elements. The latter is a good example of how the Maple 8 continue to evolve and adapt to the new normal, and we are pleased to showcase their success in an extensive feature and interview with its CIOs on pages 31-35 of this report.

Sovereign wealth funds scored on average 53%, the same as in 2024. Improvements in sustainability are evident with the “S-score” increasing from 4.0 to 4.3 this year. However, we have observed a change in mindset among certain funds that have turned more domestic, inward and opaque, reducing the average “G-score” from 7.0 to 6.8. We offer an additional analysis of this trend on page 10, demonstrating that funds are investing more at home than ever before. Resilience has stayed the same among SWFs.

In contrast to SWFs, public pension funds saw a slight drop of the total score from 70% to 69% due to the switch in focus of certain US retirement funds, which have stopped issuing regular ESG updates and/or employing ESG dedicated teams. In May 2025, Canada’s CPP confirmed it had abandoned the 2050 net-zero target it had committed to in 2022, even though it will continue with its decarbonization efforts. Together, these decisions took down the average “S-score” of PPFs from 6.2 to 6.1.

No comments:

Post a Comment